What should a PPO network look like today?

The concept of a provider network has been instrumental in the healthcare industry for more than a few decades. And, whatever the variety of the network in place – HMO, EPO, PPO, ACO – with some nuances, the idea is mostly the same…provide access to an established group of providers, and use those providers to maximize savings. Differentiating attributes, such as coverage for providers outside the network or the way care is managed within the network or the ability to select a specialist without a referral, all can change the style and price of the plan.

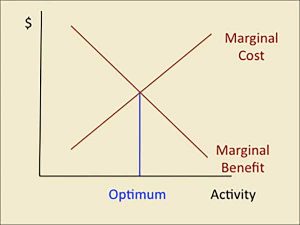

I had to think back to a college economics class to come up with the right answer to the question, as painful as that memory was for me. See the diagram below:

Historically, provider networks offered access to a sufficient or reasonable number of providers to provide access to enough providers while still obtaining a strong discount on medical services. These networks of the past were not as inclusive as many of the networks that are offered today. Somewhere along the way, the mindset changed from having good access to providers with great discounts, to having great access to providers at only good discounts. The college economics lesson was ignored and an attempt was made to contract with every provider possible in an attempt to make the network more robust.

Historically, provider networks offered access to a sufficient or reasonable number of providers to provide access to enough providers while still obtaining a strong discount on medical services. These networks of the past were not as inclusive as many of the networks that are offered today. Somewhere along the way, the mindset changed from having good access to providers with great discounts, to having great access to providers at only good discounts. The college economics lesson was ignored and an attempt was made to contract with every provider possible in an attempt to make the network more robust.

The reality is, traditional networks weren’t bad. Having every hospital system in a given network guarantees that the network will never have the best rate with each provider because by definition, it becomes impossible to have the best rate with every provider in a network. Over time, the network becomes, for lack of a better term, watered down, and the average discount percentage is reduced. This is the cost of having widespread provider access.

The question is this: are the networks in use designed for the best combination of provider savings and network access? Are there tweaks that can be made to increase savings (achieve a lower cost basis)?

At ClearHealth, we’ve heard a lot of industry folks talk about narrow networks, also referred to as high-value or direct networks. The concept isn’t new – it’s just named something different as a result of network evolution. The current implementation of the concept though, is different. Narrow or direct networks, often times created by contracting with a specific hospital system, are complemented with out-of-network access. In this model, a plan member can choose any provider they want to receive services from, however, those services rendered outside of the [hospital system] direct network are reimbursed at a maximum allowable amount – some pre-determined threshold that the plan will pay for choosing care not affiliated with the contracted providers. Medicare rates are commonly used for these out-of-network services to allow the plan a predictable level of payment at or below what the plan would have paid for services to the contracted providers.

The bottom line here is this: allowing a member to go outside of a network or outside of a contracted relationship isn’t necessarily bad. It may limit an ability to medically manage or coordinate care more effectively. However, the plan can comfortably say that it did its part by offering a selection of quality providers at a contracted rate, and where it does not have a contractual relationship, the plan offered a reasonable rate of payment for out-of-network services using the largest payer in the healthcare marketplace (i.e., Medicare) as the basis for that payment. The member receives choice in their provider selection and the plan has predictability of costs.

If we can help you design a program that offers this combination of affordability and choice, please contact me – I’d be happy to discuss some available options!